In 2023, the European Union established the Carbon Border Adjustment Mechanism (CBAM). This measure aligns with the European Union’s “Fit for 55” initiative, which positions the EU to reduce its greenhouse gas (GHG) emissions by 55% by 2030 (compared to 1990 levels). It complements the EU Emissions Tradition System (EU ETS), which is a cap-and-trade system for limiting emissions within the EU market.

What is the CBAM measure?

CBAM is a tool to prevent “carbon leakage” from goods that are entering the EU. Carbon leakage happens when EU-based companies make carbon-intensive products outside of the EU, in countries with less stringent environmental or climate policies. CBAM imposes a tariff on the carbon emissions of imported goods, to equalize the playing field for EU-based companies that adhere to more stringent emissions standards and to ensure that products circulating around the EU don’t undermine the EU’s climate goals.

As an EU regulation, CBAM is effective in all EU member states.

What goods are affected by CBAM?

In its initial years, CBAM will apply to imports of goods and certain materials (e.g. cathode active materials) and downstream products (e.g. bolts, screws, washers, rivets, etc.) whose production is particularly carbon-intensive and at most significant risk of carbon leakage. This includes:

- Cement

- Iron and steel

- Aluminum

- Some chemical industries (fertilizers and hydrogen)

- Electricity

To identify the specific products affected within these industries, the CBAM regulation contains a list of goods against which you can compare your organization’s products’ CN codes.

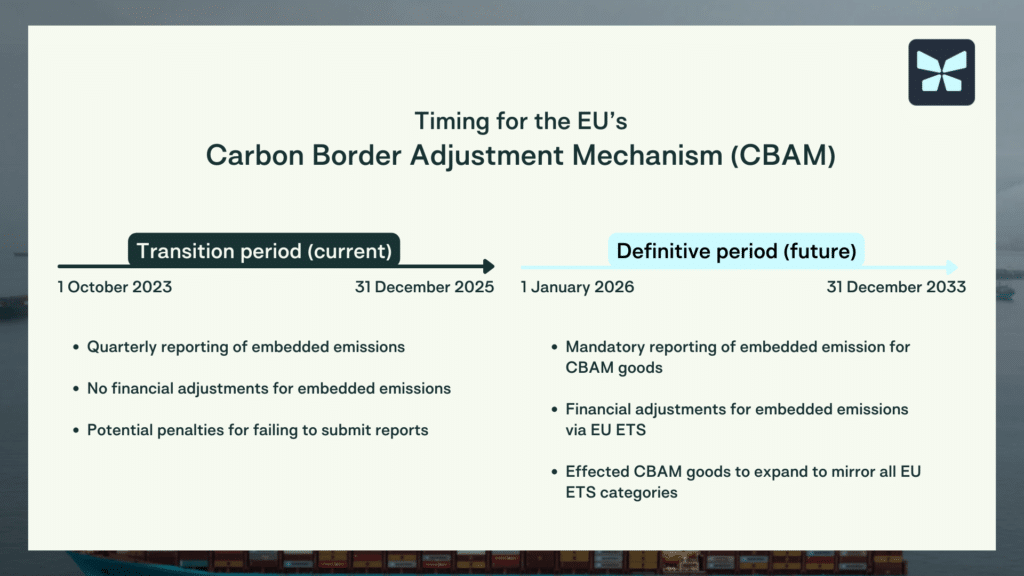

When will CBAM take effect?

We are currently in the transitional period, which lasts until 31 December 2025. During this period, companies will be required to provide quarterly reporting of embedded emissions, but will not be subject to financial adjustments for those embedded emissions. However, there are potential penalties for failing to submit reports, even during the transitional period.

Once the Definitive period begins (1 Jan 2026 – 31 December 2033), reporting for embedded emissions for CBAM goods will be mandatory. Financial adjustments for embedded emissions will be administered via EU ETS. Finally, the list of affected goods is expected to expand to mirror all EU ETS categories.

How to comply with CBAM

CBAM will impact companies in different ways, depending on whether they are an operator/producer of the CBAM goods, or a company importing those goods.

CBAM reporting for operators:

Installation operators are the persons who have direct access to information on the emissions of their installations. They are therefore responsible for monitoring and reporting the embedded emissions of goods they have produced and are exporting to the EU.

What information do you need to provide relating to the goods you produce?

- Define the emission boundary for each specific good produced

- Define the reporting period

- Emissions calculations for direct emissions (including heat flows), indirect emissions, emissions associated with precursor products, and additional qualifying parameters (such as total clinker content for cement)

- Monitor and report annually

CBAM reporting for importers of goods:

Importers are responsible for submitting quarterly reports to comply with CBAM. The first quarterly report is for the period October to December 2023. That report is due to be submitted on the CBAM Transitional Registry by 31 January 2024.

What information do you need to request from the operator in order to report?

- Define the CBAM goods imported and mapped to each “aggregated goods category”

- You will need to report the following:

- Direct emissions of the installation;

- Indirect emissions occurring during the production of installation (i.e. the electricity that your supplier consumed);

- (Optional) Precursors emissions of certain materials used in the production process

- Information on carbon price assessed in the jurisdiction where the goods or precursors were produced

Recommended CBAM compliance next steps for all companies:

- Review your internal product list and map against the EU’s eight-digit coding system (the CN code) for custom tariffs

- Evaluate which countries your organization operates in that will likely be impacted by CBAM requirements

- Determine whether you are an importer of goods or an operator of installations (or a combination of each, depending on the product)

Need help complying with CBAM?

Optera’s team of experts can help with CBAM reporting and more. Get in touch today to get started before the transitional period ends.