In a recent webinar with AEA Investors LP, Optera, and Cloverly, the panelists dug into the world of financed emissions and how private equity firms are driving decarbonization across their portfolios. You can watch the full recording here, but we’ve also summarized some key insights:

What are financed emissions?

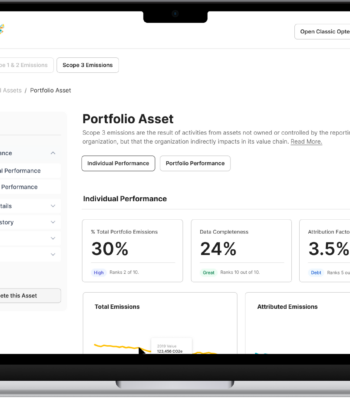

As our VP of Services, Mitch Voss, explained, financed emissions are the scope 3, category 15 emissions generated through any investment and lending activities. They’re calculated by evaluating how much stake you have in each portfolio company and they help PE firms take accountability for the emissions impact of their investments.

Why do private equity firms care about financed emissions?

Heidi DuBois, Global Head of ESG at AEA Investors LP, laid out a tiered set of motivations for investors to lean in on emissions management with their portfolio companies:

- Regulatory risk: At the baseline, portfolio companies need to be equipped to comply with emissions reporting regulations in order to avoid hefty penalties and fines. Private Equity firms, too, must be able to comply with regulations that mandate the reporting of their scope 3, category 15 emissions. It’s doing “what you have to do.”

- Running the business well: Beyond compliance, enabling portfolio companies to manage their emissions aligns with enabling them to manage their business. Finding energy and fuel efficiencies helps your portfolio companies manage costs while also reducing their emissions impact. Developing programs and policies that drive greater environmental sustainability is also a point of pride for employees, driving greater engagement and retention. It’s just good for business.

- Growth opportunities: Managing emissions isn’t just about cost savings. Planning a business model that is viable in a low-carbon future can uncover significant growth opportunities for your portfolio companies. Tax incentives for adopting new sustainable technologies, developing new product or service lines, and clearly communicating a commitment to the environment can provide a compelling competitive advantage and help your portfolio companies grow into new markets.

How should PE firms think about building climate into their due diligence processes?

DuBois shared how her firm thinks about incorporating climate into their due diligence process, and shared that the evaluation doesn’t stop there – it’s prevalent all the way through to exit. A few ways she’s seen PE firms consider climate impact in their investment decisions include:

- Climate screening criteria applied to every investment

- Climate scenario analysis, assessing both physical and transition risk

- Emissions disclosures for each portfolio company

- ESG strategy and results incorporated into confidential offering memorandum at exit

How can you empower your portfolio companies to do this work?

The speakers acknowledged that quantifying and reducing emissions, especially scope 3, can feel daunting to portfolio companies that have never done this work before. In many cases, there is not a dedicated ESG team to lead this work. Both Voss and DuBois agreed that identifying an internal champion, preferably on the senior leadership team, is critical for driving the work forward within each portfolio company. Starting small – for example, beginning with just scope 1 and 2 data collection – can also help ease the fears of your portfolio companies so that you can build the muscle to tackle more complex decarbonization goals in the future.

Voss shared that the development of an ESG playbook has been critical in helping Optera’s clients move their portfolio companies toward decarbonization. When tailored to each portfolio company, the playbook can help their champions evaluate renewable energy options, energy efficiency projects, and other decarbonization best practices. The goal is to enable the portfolio companies to carry the torch in the long term, even after they develop their emissions inventory.

As DuBois shared, any change management initiative involves a high level of interpersonal work, and decarbonization is no exception. This is where PE firms can really provide value to their investment companies – connecting peers across their portfolio, setting up quarterly meetings to share best practices and troubleshoot common challenges, and creating cohorts of companies that are at a similar level of maturity. This not only builds networks and learning, but it also drives innovation across your portfolio – ultimately the goal of any investment firm.

Watch the full webinar

Learn more about how Optera helps private equity firms manage and reduce their financed emissions.