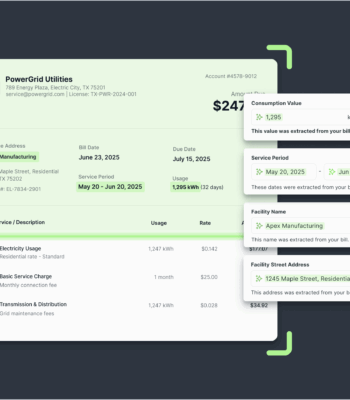

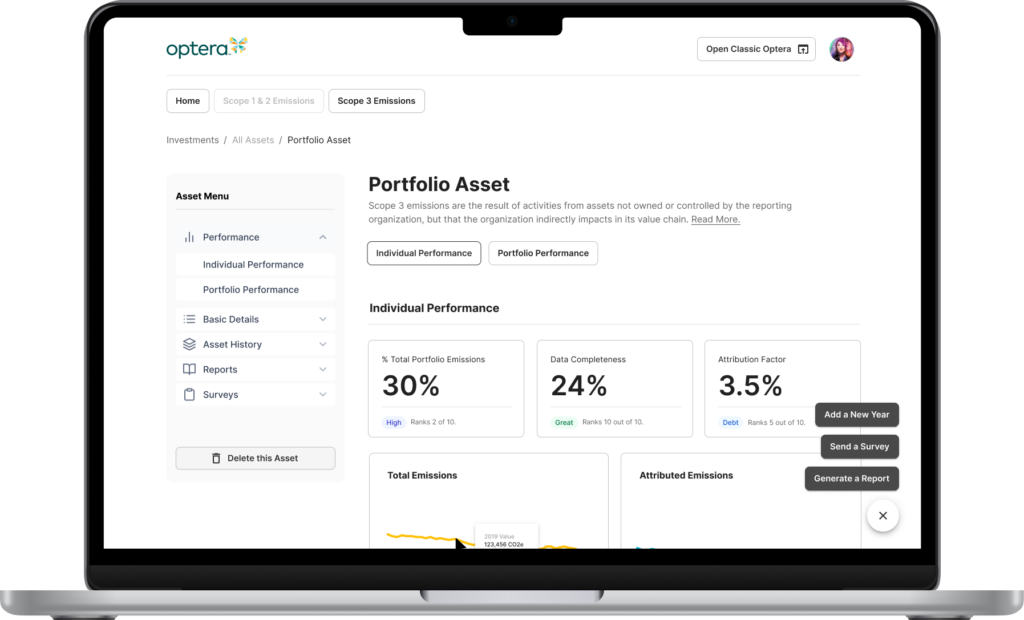

We’re excited to announce the launch of Optera’s new investments product, designed to help financial institutions track and reduce their investment portfolio emissions. The software, now available in beta, helps investors align their scope 3 emissions accounting with the Partnership of Carbon Accounting Financials, bring together their portfolio’s direct emissions data where it exists (and estimate based on Optera’s extensive database where it doesn’t), and collaborate with portfolio companies to develop their ESG programs.

The product also enables investors to take meaningful action on Science-Based Targets Initiative (SBTi)’s latest guidance for financial institutions. The guidance calls for financial institutions to measure the climate impact of their investment and lending portfolios, and work with their investees to set targets that would reduce greenhouse gas emissions in line with the goals of the Paris Climate Agreement (keeping global warming below 2℃, or preferably 1.5℃).

A new wave of sustainable investing

Investors and financial institutions have played an essential role in shaping voluntary climate disclosures and climate action over the last few decades. Organizations like CERES with Climate Action 100+ and The Net Zero Asset Managers initiative have gathered groups of leading investors to make meaningful progress across the corporate sector. This work has laid the foundation for investors to address climate change, but now investors are encouraged to step up like never before.

With 2030 just around the corner, it’s clear we no longer have the luxury of time. All financial institutions and investors, not just those with the longest investment horizons, need to consider climate risk and climate impact in their investment decisions if they hope to remain competitive. What used to be a nice-to-have is now urgent and essential, both for economic resiliency and for the health and safety of our planet.

Optera has been on the leading edge of corporate climate action since our founding in 2006. We have experienced for ourselves how disparate, low-quality emissions data has hampered progress for organizations trying to build a sustainable investment strategy. Today’s beta launch of Optera Investments ushers in a new era of sustainable investing – using tangible and actionable emissions data across all business sectors and sizes to help investors track, benchmark, and reduce their climate impact across their entire portfolio.

It’s time to pay attention to investment portfolio emissions

Investors have the power to shape corporate priorities. The pace at which investors act will determine the pace at which corporations act. And to achieve net-zero emissions by 2050, we all need to act fast. Within Optera’s software, you can consolidate the primary emissions data you have, and use our extensive and validated database to model the emissions you don’t. No matter where you’re starting, our expert team is here to help you make meaningful progress across your portfolio, starting now.

Want to learn more? Request a demo.