This guide was last updated: March 2025

The European Union is on a mission to achieve net-zero emissions by 2050, and its most significant corporate sustainability regulation to date is the Corporate Sustainability Reporting Directive (CSRD). When first introduced, CSRD dramatically expanded the scope and depth of sustainability reporting for companies operating in the EU—and even those based outside the EU with significant EU business.

However, in February 2025, the EU Parliament introduced the Omnibus Proposal, which, if approved, will cause significant changes to CSRD’s thresholds, timelines, and requirements. While CSRD remains a landmark directive, businesses must stay current with these changes to ensure compliance.

This guide was updated in March 2025 to reflect the latest state of CSRD under the Omnibus Proposal. We plan to update this resource as the proposal moves through the EU Parliament since further changes will likely occur.

For a condensed summary of this guide, click here to download our CSRD Executive Summary.

What is the Corporate Sustainability Reporting Directive (CSRD)?

CSRD is a directive requiring companies operating in the EU to report on environmental, social, and governance metrics. It replaced, and significantly expanded, the scope of the Non-Financial Reporting Directive (NFRD).

What makes CSRD important?

CSRD was, and still is, a game-changing climate regulation for several reasons:

- Scope: The original CSRD required over 50,000 companies—including non-EU companies with significant EU operations—to report on their environmental and human rights impacts. If the Omnibus Proposal is passed, the number of affected companies will be reduced. However, CSRD will still apply to the largest companies and major emitters, ensuring coverage of those with the most significant climate impact.

- Double materiality: Companies must consider “double materiality”– both the impact of ESG matters on their operations, and the impact of their operations on the environment and communities. Double materiality assessments require companies to identify and directly engage with stakeholders within their organization, their value chains, and the communities in which they operate to gain a holistic understanding of the impacts of their business.

- Third-party assurance: Independent audits of sustainability data are required, raising the bar for data quality and trustworthiness.

- Standardized reporting: CSRD reporting follows the ESRS, ensuring consistent and comparable disclosures.

- Value chain considerations: Companies must disclose value chain emissions, including upstream suppliers and downstream customers, extending accountability beyond direct operations and influencing global supply chains, even for non-EU partners.

- Strict penalties: Penalties for not complying with CSRD include enforcement actions, fines, and potential jail time, depending on EU member state law.

However, the Omnibus Proposal introduces new exemptions, adjusted reporting thresholds, and delayed timelines, making compliance requirements more nuanced than before.

What is the Omnibus Proposal and how does it impact CSRD?

In February 2025, the European Commission published the Omnibus Proposal to reduce the scope and reporting requirements of CSRD and other EU regulations, easing reporting burdens for small and medium-sized businesses.

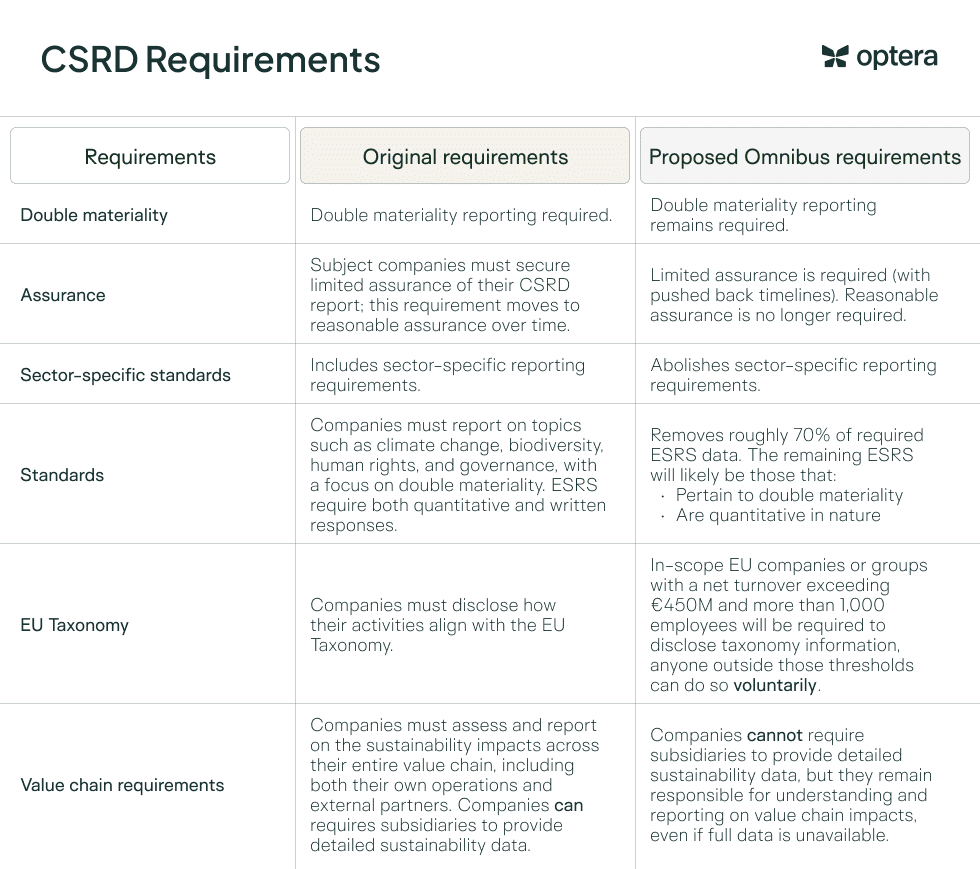

The key ways that the proposal will impact CSRD, if approved, include:

- Significantly raising reporting thresholds, reducing the number of companies subject to report

- Extending reporting deadlines by two years for many of the companies still subject to report

- Removing requirements for reasonable assurance

- Abolishing sector-specific reporting requirements

- Reducing value chain requirements, lessening burdens on value chain members

While the Omnibus Proposal is expected to become law, further adjustments to thresholds, timelines, and requirements may occur during the legislative process.

Scope: Who is required to report?

Originally, about 50,000 companies were required to report under the CSRD, including non-EU companies generating revenue within the EU through a local branch or subsidiary.

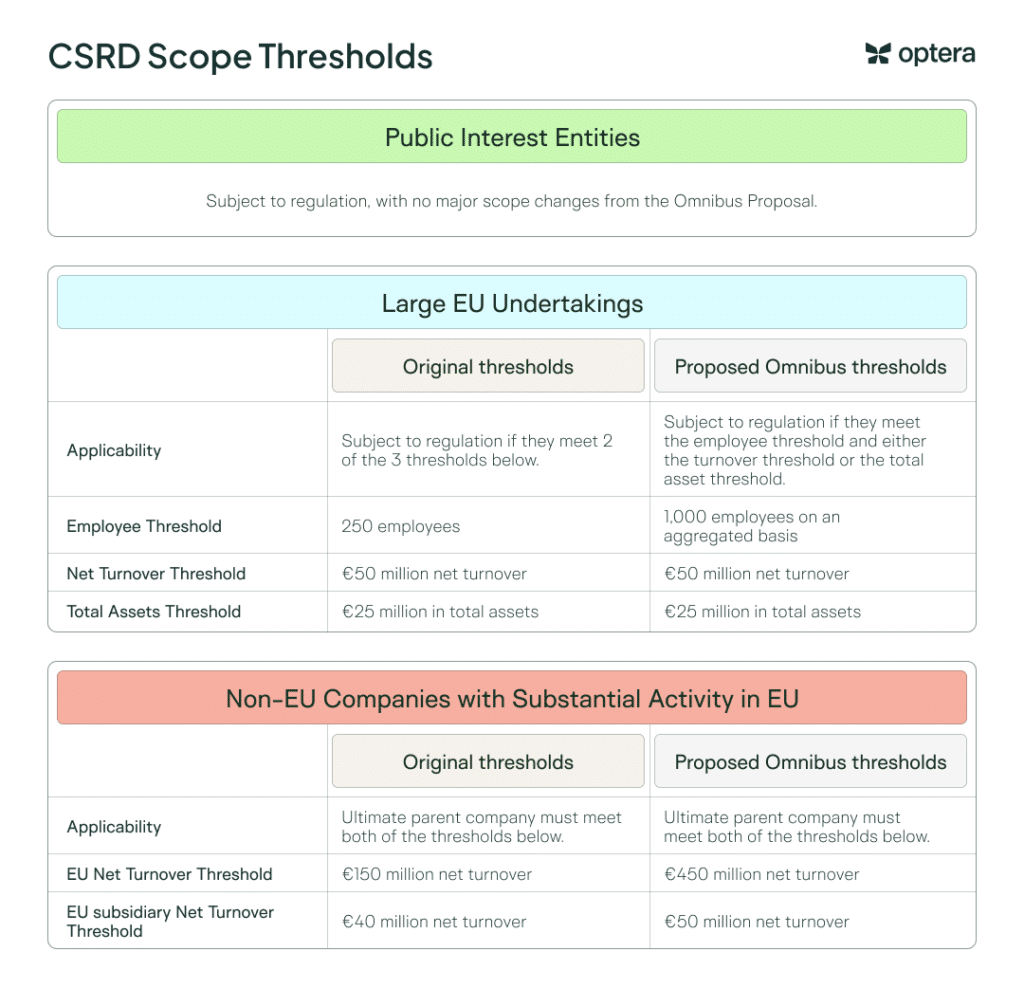

However, the Omnibus Proposal introduces changes that, if passed, will exempt many SMEs from compliance by raising thresholds—such as employee count and revenue minimums—removing about 80% of the companies originally required to report, while still capturing roughly 90% of emissions from the original framework.

These changes, however, will not impact public interest entities that are already required to report under the NFRD.

Timeline: When does reporting start?

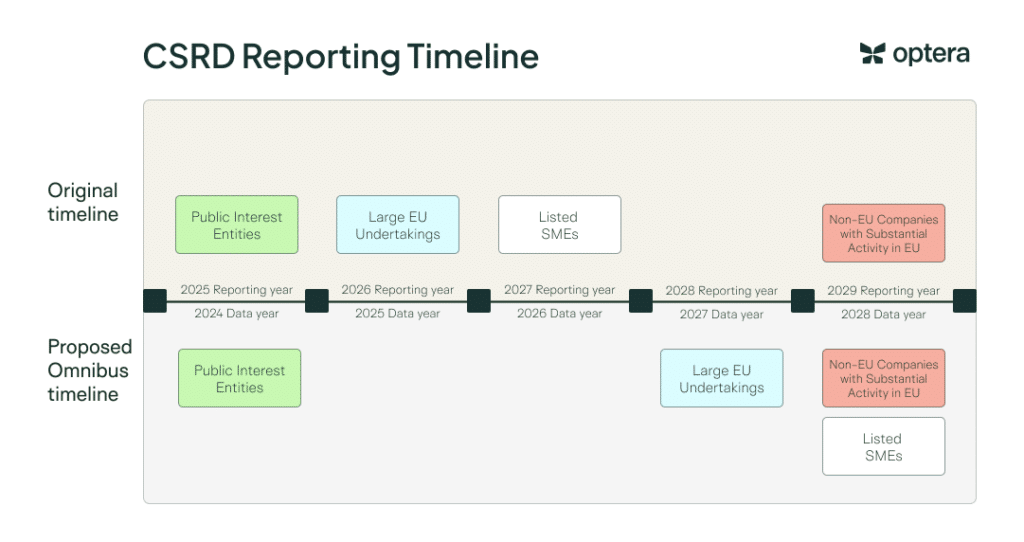

The European Commission’s Postponement Directive, part of the proposed Omnibus package, includes a two-year delay for companies that are not yet obliged to report under CSRD. However, if the Omnibus Proposal is passed, companies already required to report—such as public interest entities—will still follow the original timeline, with the first reports due in 2025.

As of February 2025, the original CSRD is already in the transposition process across many EU member states. Even if your CSRD timeline is delayed by two years because of the Omnibus Proposal, you may still be required to report in countries where the regulation is already in effect and will remain so throughout the Omnibus approval process.

Expected timeline for the Omnibus Proposal to become law

The time taken for a proposal to become a directive in the EU can vary greatly, from just 11 months to over 24 months. More complex proposals that require second readings or conciliation can extend the timeline.

As of March 2025, the Omnibus Proposal is under consideration by both the European Parliament and the Council. The European Commission has urged these bodies to prioritize and fast-track the proposal through the “urgency procedure,” aiming to accelerate the process.

Once an EU directive is adopted, member states are required to transpose it into national law within a specified timeframe, typically provided within the directive itself. For instance, the original CSRD allowed approximately 18 months for transposition.

The timeline for adoption remains uncertain, but the directive is expected to take several months to progress through the process before becoming law in EU member states.

For detailed information on the EU legislative process, check out this resource from the European Parliament.

Requirements: What do companies need to report?

The CSRD requires in-scope companies to disclose a broad range of sustainability-related information under the European Sustainability Reporting Standards. These standards are designed to enhance transparency, consistency, and comparability in sustainability reporting across the EU.

A key principle guiding CSRD reporting is double materiality, which determines what companies must report.

What is double materiality in the context of CSRD?

CSRD mandates that companies report only on sustainability topics that are material to their business. However, the directive requires a double materiality assessment, meaning companies must evaluate materiality from two perspectives:

- Financial Materiality (“Outside-In”) – How sustainability and environmental concerns may affect a company’s financial performance, risks, and long-term value creation.

- Impact Materiality (“Inside-Out”) – How a company’s activities, operations, and value chain affect the environment and people, including employees, communities, and consumers.

If a sustainability issue meets either financial or impact materiality criteria, it must be reported. This means companies cannot ignore a topic simply because it does not pose a financial risk—if their activities have a significant environmental or social impact, disclosure is required.

Double materiality remains a non-negotiable principle of CSRD, even under the proposed Omnibus simplifications.

Original CSRD reporting framework

Under the original CSRD framework, companies must adhere to ESRS, developed by the European Financial Reporting Advisory Group (EFRAG).

Key ESRS include:

- Climate Change: Adaptation and mitigation strategies

- Energy and Pollution: Emissions, pollution impact, and hazardous substances

- Water and Biodiversity: Water use, marine resource extraction, and biodiversity loss

- Circular Economy: Resource use, waste management, and sustainability initiatives

- Social and Governance Factors: Employee rights, community impact, consumer protection, corporate ethics, and business conduct

- Business Conduct: Whistleblower protections, lobbying activities, corruption and bribery

Companies must determine which of these topics are material to their operations through a double materiality assessment and report accordingly.

Proposed simplifications under the Omnibus Package

In response to concerns about the reporting burden, the European Commission’s Omnibus package proposes streamlined reporting requirements while preserving the core sustainability objectives of the CSRD.

Key revisions include:

- Reduction in mandatory data points: The number of required disclosures will be significantly reduced to focus on the most critical sustainability metrics, decreasing complexity and administrative effort.

- Emphasis on quantitative data: The updated framework prioritizes numerical disclosures over qualitative narratives, improving clarity and comparability across reports.

- Alignment with global standards: ESRS will be harmonized with international frameworks, such as those from the International Sustainability Standards Board (ISSB), to streamline requirements for multinational corporations.

How to prepare for CSRD compliance

If and when you are required to comply, here are six steps you should follow.

- Conduct a double materiality assessment – Determine which ESRS 1 topics (and subsequent ESRS standards) are material to your company based on financial and impact materiality.

- Map existing data and identify gaps – Review current sustainability reports, list ESG metrics you’re already tracking, and cross-reference them with ESRS requirements to pinpoint any missing data.

- Build or improve your data collection system – Upgrade your existing ESG data management platform or implement a new one to ensure data is consistent, auditable, and accessible for reporting.

- Prepare data and report content – Draft disclosures for each material ESRS topic identified in the double materiality assessment and ensure information is formatted correctly. Reports must be machine-readable, with sustainability topics tagged using XBRL.

- Complete third-party assurance – Implement internal controls, conduct an internal review, and initiate an external assurance process to verify the accuracy of reported data.

- Publish and file – Publish your sustainability report within the annual management report and file it with the relevant authorities, including the National Competent Authority (NCA) for each EU member state where you operate. Publicly traded companies must also file with the relevant stock exchange.

As new guidance and regulatory updates emerge, ongoing monitoring is essential. Consider subscribing to our newsletter to stay informed on the latest changes to CSRD and ensure your reporting remains aligned with the latest standards.

CSRD non-compliance penalties

CSRD non-compliance penalties have been left to member state discretion, meaning penalties can vary widely across the EU. However, enforcement mechanisms generally include fines, legal actions, and reputational risks for non-compliant companies.

For example, Czechia will impose fines of up to 3 percent of a company’s assets for an incomplete report, or up to 6 percent of a company’s assets for failure to report. France has introduced personal liability with fines and jail time for company directors.

The EU Omnibus proposal will not significantly impact non-compliance penalties for CSRD if it is passed.

Need help complying with CSRD?

CSRD compliance requires both the right technology and expert guidance. Companies must track and report sustainability data in line with ESRS, ensure audit readiness, and submit disclosures in XBRL format.

A carbon accounting platform helps streamline data collection, automate calculations, and maintain audit-ready records. However, given the complexity of CSRD—especially its overlap with other regulations like the Corporate Sustainability Due Diligence Directive (CSDDD) —many companies will also benefit from sustainability consulting to interpret requirements, define materiality, and ensure compliance.

Set yourself up for CSRD success – learn more about our CSRD solutions or get in touch with our team today.