Businesses have a significant role in reducing greenhouse gas emissions and mitigating the impacts of climate change. In response to the climate crisis, California has passed two new regulations requiring businesses to disclose their climate-related information: Senate Bill 253 (SB253) and Senate Bill 261 (SB261).

After asking the California legislature to delay the implementation of the two bills—and being denied—Governor Gavin Newsom signed SB219 into law at the end of September, approving a series of amendments to the two climate bills. The California Air Resources Board (CARB) has indicated that they will not pursue enforcement actions during the first year, as long as companies have demonstrated a good faith effort to comply.

SB253 sets reporting guidelines for the biggest organizations

SB253 amends certain provisions in the previously enacted California Global Warming Solutions Act of 2006. That act mandates the State Air Resources Board to establish rules for reporting and verifying greenhouse gas emissions statewide and ensuring legal compliance. The act also stipulates that the state board must publish data annually on greenhouse gas, criteria pollutant and toxic air contaminant emissions for every reporting facility.

This new bill requires the California State Air Resources Board to create and implement regulations by July 1, 2025, requiring any public, private or LLC company generating more than $1 billion in annual revenues and operating in California to disclose and verify their scope 1, 2 and 3 greenhouse gas emissions.

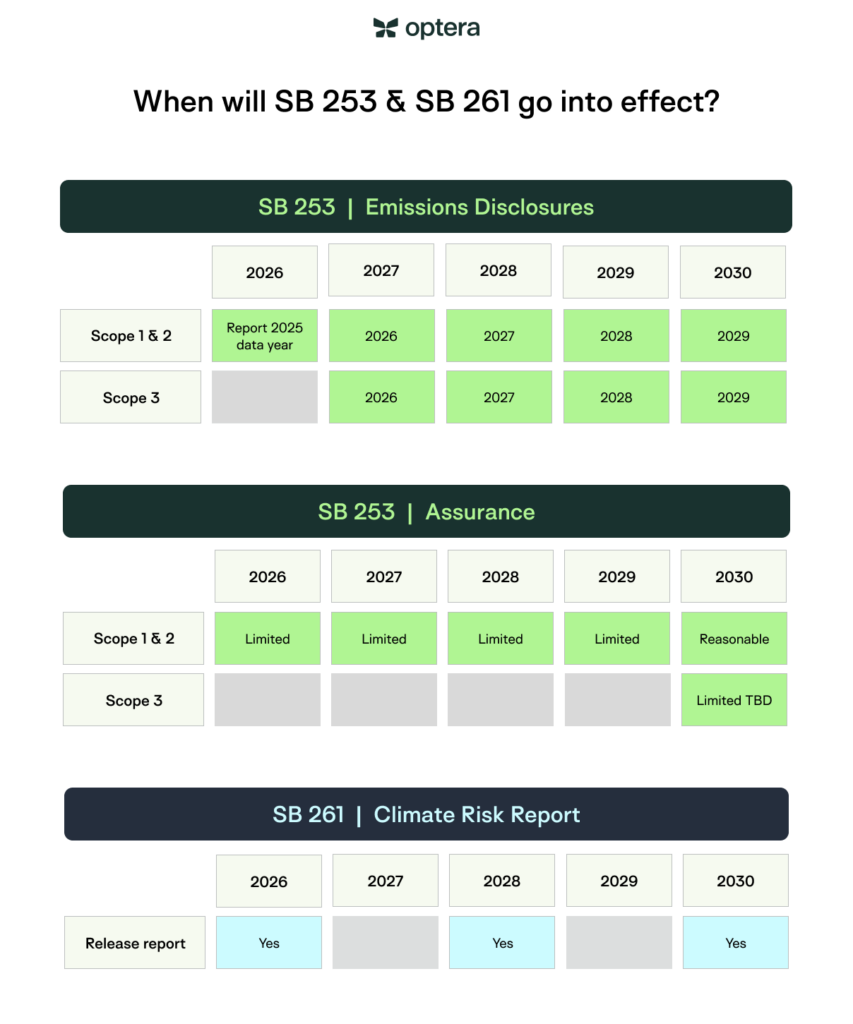

In 2026, these companies must report scope 1 and scope 2 emissions on the 2025 data year. The deadline for reporting scope 3 emissions is up to the California State Air Resources Board, thanks to the amendments in SB219. The assurance for scope 1 and scope 2 emissions is required at a limited level in 2026 and a reasonable level by 2030. Assurance for scope 3 is yet to be determined but will be required at a limited level in 2030.

Scope 1 emissions come directly from a company’s operations, such as its manufacturing facilities or vehicle fleet. Scope 2 emissions are those generated from electricity the company purchases. Scope 3 emissions stem from actitivies essential to running your business but lie outside your direct operations control; this encompasses your supply chain, the use of products, and investment assets among other sources.

According to the bill, GHG emissions will be measured and reported in conformance with the Greenhouse Gas Protocol standards and guidance, including the Greenhouse Gas Protocol Corporate Accounting and Reporting Standard and the Greenhouse Gas Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard. The annual fee for disclosure may not exceed $1,000.

SB261 sets the foundation for more financial risk reporting

SB261 takes effect by January 1, 2026, and every two years thereafter mandates that corporations, partnerships, LLCs or other businesses generating revenues of more than $500 million in annual revenues must produce a climate-related financial risk report every two years per the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). It is expected to impact about 10,000 companies globally.

The TCFD is a global body that has developed a framework for companies to detail their exposure to climate-related financial risks and the measures they have taken to mitigate and adapt to them. Companies must also publish their report on their website.

The bill also requires the state board to contract with a climate reporting organization to create a public report. The report must include:

- An assessment of the climate-related financial risk disclosures in publicly available reports.

- An analysis of the state’s systemic and sector-specific, climate-related financial risks.

The state board must also implement regulations empowering it to impose penalties on businesses that fail to publish or produce an insufficient required report. SB261 also requires covered companies to pay an annual fee, which covers the state board’s costs in administering and implementing the bill. These fees will be deposited into the Climate-Related Financial Risk Disclosure Fund, with funds distributed to the state board to create an ongoing budget allocation for SB261’s management.

What do these bills mean for businesses in California and nationwide?

The scope 3 requirements appear to be more strict than the Securities and Exchange Commission (SEC) proposal, both in their disclosure depth and breadth and the verification requirement. And because of the wording regarding scope 3 requirements, these bills will likely include all categories relevant to given reporting organization (e.g. Category 14: Franchises for quick service restaurant; Category 15: Investments for banks and private equity; etc.)

The TCFD disclosure requirements, as stated in SB261, are also more strict than the SEC proposal but somewhat less strict or detailed than what the EU’s Corporate Sustainability Reporting Directive (CSRD) requires, especially with scope 3 and the supply chain.

California’s SB 253 and SB 261 are significant new regulations requiring businesses to disclose their climate-related information. These regulations are expected to substantially impact companies operating in California and send a strong signal to other states and countries that climate disclosure is essential for businesses to succeed in the 21st century.

Optera has a proven track record spanning nearly two decades of conducting GHG protocol-compliant accounting. Our expertise covers scope 1, 2 and 3 emissions to ensure our clients’ data aligns seamlessly with SB253 requirements. We’ve drawn on over 10 years of experience providing assurance services ourselves to design our platform to facilitate 3rd party auditing, and we’ll keep improving and enabling review processes and auditor access in the future. Currently, more than half of our customers conduct 3rd party assurance to validate data our dedicated team and platform help to generate.