Today, we published our second annual research report on trends in corporate emissions management, and it serves as a stark snapshot of the state of our industry. Corporate emissions management programs are more mature than ever—but still facing significant headwinds in managing their emissions data. Corporate leaders grasp the importance of sustainability as a competitive differentiator, but are still relying on a patchwork of general purpose tools to manage their program. A majority of large companies are actively working with suppliers to decarbonize their value chain, but collecting upstream emissions data continues to be an uphill battle.

These are just a few of the key findings we uncovered in this year’s survey, which represents a wide-ranging group of climate programs at large companies. We surveyed 90 sustainability leaders at companies with at least $500 million in revenue. Respondents answered from North America, the United Kingdom, Germany, France, and Spain. We surveyed a mix of sectors, including Automotive, Consumer Electronics, CPG, Financial Services, Healthcare, IT, Manufacturing, Retail, and Telecommunications.

Keep reading for some of the report’s headline trends, and download the full report for over a dozen key findings along with our analysis.

Key Trends Shaping Corporate Emissions Management in 2024

Trend 1: Sustainability as a Competitive Advantage

Among the large corporations we surveyed, the link between sustainability efforts and competitive advantage is clear. A striking 76% of respondents ranked product and brand differentiation as one of their top three motivations for tackling corporate emissions. This finding indicates that executives are paying close attention to buyer behavior—a 2024 PwC study found that consumers indicated they’d be willing to pay up to 10% more for goods that are produced sustainably.

We identified four additional motivators for corporate emissions management. Download the report to see how they stack up.

Trend 2: Widespread Adoption of Emissions Reporting

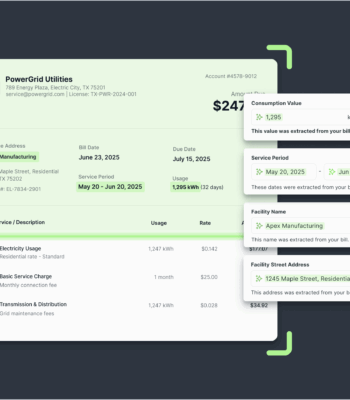

Our survey on corporate emissions management found that 91% of respondents indicated that their company reports emissions either publicly or to regulators and customers, demonstrating a widespread up-leveling in corporate climate program maturity compared to last year’s report. However, that maturity has not yet translated to adoption of dedicated GHG management platforms, with only 76% of respondents saying that their program relies on spreadsheets, general business intelligence tools, EHS platforms, or DIY tools.

For more analysis on this gap between program maturity and tool adoption, download the full report.

Trend 3: Focus on Supply Chain Emissions

While most of the large companies we surveyed have established their management of direct or owned emissions, their focus is shifting to the more complex challenge of managing their scope 3 emissions. Nearly 70% of respondents are actively working across their value chain to help their suppliers decarbonize. This focus on supply chain emissions is crucial, as they often represent the majority of a company’s total emissions footprint. According to CDP, supply chain emissions are on average 11.4 times higher than operational emissions.

For deeper analysis on the challenges of supply chain emissions management—and a glimpse at how respondents plan to use product-level emissions data—download the full report.

Trend 4: Enthusiasm for AI in Carbon Management

Our survey reveals a striking contrast between the enthusiasm for future technologies and the current state of carbon management tools in use today.

ESG practitioners show significant openness to AI adoption across various carbon management functions. This enthusiasm is particularly pronounced for report generation and forecasting decarbonization impacts, with over 60% of respondents open to AI use (with human oversight) in these areas. Despite this forward-looking enthusiasm, the present reality of carbon management tools tells a different story: only 24% of respondents use tools specifically designed for emissions management. Survey respondents elaborated on their biggest challenges in emissions data management—download the full report to see what they had to say.

Stay ahead of the curve with more insights from this year’s report

As this brand-new research shows, corporate emissions management is at an inflection point, presenting both opportunities and challenges for sustainability teams. From leveraging sustainability actions as a competitive advantage to the increasing focus on supply chain emissions, this moment presents both opportunities and challenges for hardworking corporate sustainability teams. The future of this work is exciting, with AI opening the door to new capabilities, but the gap between ambition and execution persists, and highlights the need for more robust, dedicated GHG emissions management tools.

These findings underscore how critical it is for companies to stay abreast of changes in our field—and keep themselves ahead of the curve as much as possible. Regulations are getting stricter, and stakeholders from customers to investors are increasing their expectations for emissions transparency. Those who fail to adapt risk getting left behind.

Don’t miss out on the actionable insights from this year’s full report. They’ll help you benchmark where your corporate emissions management program lies in comparison to your peers and competitors. The key takeaways within the report will help illuminate the road ahead, with next steps and action items clearly outlined.